The number of people falling behind on their credit card bills increased in 49 of the 50 states last year, a sobering new report reveals.

As inflation took its toll on household budgets, Americans in their millions became delinquent on credit card debt – with some states much more badly affected than others.

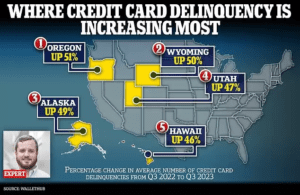

According to analysis by WalletHub, the number of borrowers struggling to keep on track of their credit card bills has risen the fastest in Oregon. Between September 2022 and September 2023, delinquencies in the state soared by 51 percent. Generally, payments are reported to the credit bureaus as delinquent once they are 30 days past due. Being delinquent on a credit card is damaging for your credit score and late payments remain on your credit report for seven years, experts warn. The report, which lays bare how raging inflation and sky-high interest rates have left a scar on the nation’s finances, comes as Americans’ total credit card balances soared to a record $1.08 trillion in September last year.

While some credit card delinquency is always inevitable, when the rates of delinquency increase, that can indicate that the economy as a whole is struggling, the report said. WalletHub found that as of September 2023, 16.62 percent of credit card tradelines in Oregon were delinquent – up 51.09 percent from the year prior. The study found that one reason why Oregon’s delinquency rate is increasing so much is that its residents are simply borrowing more.

A separate report by the personal finance site found that the average household debt increased by $754 in the year to September 2023 – the tenth biggest increase of any state. It suggested that this borrowing surge has led to an increased number of households who are finding it more difficult to pay back their bills. People in Oregon also increased the frequency of their bankruptcy filings at the second-highest rate in the country during the past year, it found.

While the Beaver State has seen the largest increase in borrowers falling behind on payments, Mississippi is the state with the highest number of delinquent accounts overall. The study found that as of the end of the third quarter last year, 39.14 percent of credit card tradelines were delinquent in the Magnolia State.

After Oregon, delinquencies rose at the second fastest pace in Wyoming – up 49.74 percent over the year. Alaska residents were behind on payments for 48.88 percent more credit cards over the year. In Utah, the study found, the average number of delinquencies rose 46.86 percent between September 2022 and September 2023, and 46.08 percent in Hawaii. According to WalletHub, people in Wyoming and Alaska have some of the highest average credit card debt in the country. High levels of debt coupled with high interest rates can easily lead to increased levels of delinquency, the report added.

Interest rates remain at a 22-year high of between 5.25 and 5.5 percent – which has pushed up the cost of borrowing. ‘When you are delinquent on credit card debt, it is important to make a game plan to get your account current as soon as possible, as long-term delinquency can lead to severe credit score damage,’ said WalletHub editor John Kiernan. ‘If you’re late on your payment by fewer than 30 days, paying before the 30th day will keep your delinquency from being reported to the credit bureaus.’

Be aware, however, that you may still incur a late fee. To avoid falling into delinquency on your credit card bills, WalletHub recommends simple steps such as monitoring your spending and creating a realistic budget. Schedule automatic payments for at least the minimum amount due on your credit cards. This reduces the risk of missing a payment deadline. If you are facing financial challenges, communicate with your creditors early, it recommends. They may be able to offer temporary solutions, such as a modified payment plan, to help you avoid delinquency.